The current program in the united states will give you a 30 credit for 2019 and 26 for 2020 of the installation cost of your solar power system.

Grant for solar panels on private home texas.

In addition to federal credits consider applying for local and state incentives.

And the power produced by these installations is increasing rapidly.

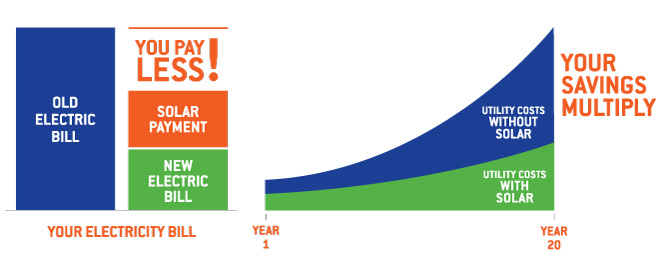

Regardless of the exact cost of installation there are many affordable financing options for solar panel systems.

You have to purchase and install the system first and then you can apply for the credit.

Disabled veterans are eligible to apply to several grant programs that support the use of solar power in residential homes.

Combine the falling cost of solar equipment and installation state rebates property tax exemptions and the 30 federal tax rebate and you have compelling reasons to go solar in texas.

A recent report by environment texas and frontier group indicates san antonio leads the state in solar pv capacity and ranks eighth among u s.

Texas is the second largest state in the country with a population of almost 28 million people and it has been one of the top 10 solar states since 2017 that s when the number of homes in texas powered by solar photovoltaic pv systems reached 225 726 with a total solar investment of 3 223 34 million.

Utah energy grants rebates loans incentives.

Grants for high energy costs.

Tennessee energy grants rebates loans incentives next post.

Federal solar energy grants for homeowners green retrofit grants.

Here are some examples.

If you live in austin you can get a rebate of 2 500.

Homeowners are eligible to borrow up to 25 000 and have as long as 20 years to make any energy improvements approved by fha and hud.

Plus you re eligible for austin energy s value of solar tariff which pays you 0 097 for every kilowatt hour kwh your solar panels can generate.

A solar payback period is the amount of time it takes for property owners who install solar panels to recover their initial investment through electricity savings.

Department of agriculture has high energy grants valued up to 20 000 for rural.

Created by the federal housing administration the powersaver helps individuals make cost and energy effective improvements to their homes including the installation of solar power systems.

While texas doesn t have a statewide solar tax credit or solar rebate program many utilities large and small and local governments offer incentives to homeowners who want to go solar.

Solar panels can be mounted on the roof of a home or in another area with unobstructed access to the sun and can provide some or all of a home s electricity.

Texas needs more solar homes says study previous post.

A sales tax exemption means that homeowners and businesses would not have to pay any state sales tax on their solar panel system.

Department of housing and urban development offers grants for home improvements using.

/Solarpanels-3156a12e053e49c88e4d7f53254fb8a8.jpg)